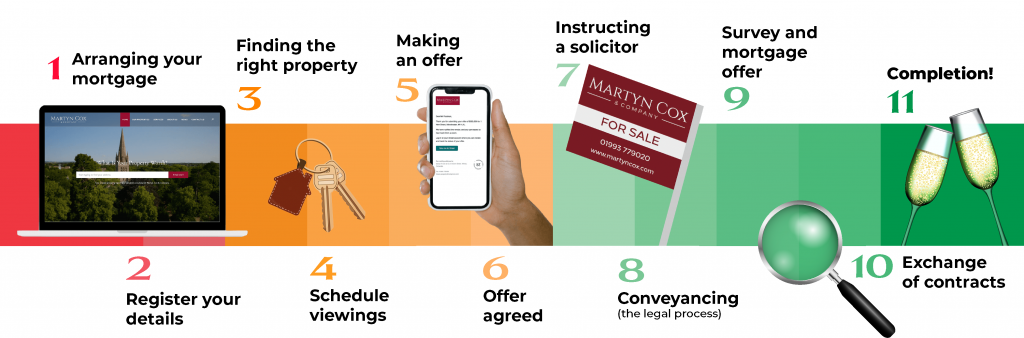

A Guide to Buying Property

This simple step by step guide has been designed to take you through the buying process.

Step 1. Arranging your mortgage

Before you begin your property search, it is advisable to arrange your finances and if required, have a mortgage agreed in principle. This will confirm how much money you will have to fund the purchase, which will ultimately influence your decision. Our recommended mortgage broker, The Mortgage Company, has access to the entire market, as well as exclusive deals and rates to help find you the best mortgage available.

Step 2. Register your details

The first step to finding the right property is to register with us either by calling us on 01993 779020 or visiting our office to discuss your property requirements with one of our experienced staff. You can also click here to send us an email.

Step 3. Finding the right property

We will have a clear understanding of your requirements and will keep you up-to-date via email and SMS alerts when new properties become available. Full color brochures will also be available.

Step 4. Schedule viewings

We, as a professional agent, we host all of our viewing appointments, answering any questions you may have. We are available six days a week and alternative arrangements can be made for out of hours requests.

Step 5. Making an offer

Once you have found your ideal property, we will put forward an offer to the seller on your behalf, both verbally and in writing including any special conditions regarding your offer. We will verify with you at this time, your ability to proceed with a purchase (eg your mortgage agreement in principle). Neither side is legally bound at this point.

Step 6. Instructing a solicitor

It is advisable to use a solicitor who knows the area you are moving to and specialises in conveyancing. If you would like a recommendation in this regard, please do let us know.

Step 7. Offer agreed

Once your offer is accepted we will prepare a Memorandum of Sale (which sets out the terms of the agreement and puts the solicitors in touch with each other) – this will be issued to the seller, buyer and both parties solicitors.

Step 8. Conveyancing (The legal process)

At this stage in the process, the transaction is known as being “in solicitor’s hands”. There is still much to do before you move, which is why having a good solicitor in the driving seat is vitally important! All progress updates that we get from here will come directly from your solicitor, another reason to choose wisely.

Step 9. Survey & Mortgage Offer

A survey will be booked on behalf of the mortgage lender to advise on the property’s value and suitability for mortgage purposes. After the mortgage valuation is received by your lender, and various other checks have taken place, a formal offer of a mortgage will be sent to you and your solicitor.

If there is no mortgage involved, a private survey and valuation will need to be commissioned. Whilst this is recommended, it is not essential.

Step 10. Exchange of Contracts

When all of the legal enquiries have been dealt with, and funding is in place, both solicitors will call the clients in to review the documentation and sign the contracts. Your solicitor will require a deposit, usually 10% of the purchase price, unless you have a related sale. In this instance, the deposit that is paid to your solicitor by your purchaser’s solicitor, would ordinarily be sufficient. Solicitors usually use Law Society Formula B, which is a telephonic exchange of contracts, at this point the seller is legally bound to sell to you and you are legally bound to buy.

Step 11. Completion

A completion date is set on exchange of contracts, and is usually around two weeks after exchange. The completion date is the day that your solicitor will technically pays for the property and ownership transfers to you. Congratulations, you are now the legal owner of your home!

Testimonial

Don’t just take our word for it. Here is someone you might recognise.